Over the course of my career, I have had the privilege to meet a range of founders, bank ex-CEOs, technologists, entrepreneurs and investors throughout the fintech ecosystem.

The work taking place is truly extraordinary and has transformed our relationship with financial services. But through my observations I have seen one thing missing.

The lack of transparency around fintech operators to report on their own environmental impact.

Digitisation & Net-Zero

This has come as somewhat as a surprise given the critical intersection fintech plays between financial services and technology in driving greater digitisation, which as we know, is the cornerstone to a net-zero future.

Today, we can analyse bank statements to demonstrate the CO₂ emissions from people’s lifestyles to innovative platforms which provide energy efficiency recommendations for homeowners, based on their address.

And whilst fintech companies continue to support customers and businesses reduce their carbon emissions, there has too often, been a failure to turn the mirror around and assess the impact fintech company operations themselves are having on the environment.

Measuring the ‘E’

In part, this is due to the very nature of strategic priorities for fintech company owners, who are focused on business growth and building brand awareness rather than environmental reporting.

But this is beginning to change, as regulators around the world begin to outline greater detail on climate reporting. Earlier this year, 1300 of the largest UK-registered companies and financial institutions became subject to Task Force on Climate-related Financial Disclosures (TCFD) reporting, which follows a similar trajectory to Japanese and New Zealand regulators.

And what we are seeing is a trickle-down effect, with firms of all shapes and sizes beginning to report voluntarily to get ahead of the curve.

This growing awareness is reflected in the results of a survey of senior executives in the fintech and financial services sector, which we released last month in conjunction with FINTECH Circle.

What it showed is survey respondents growing awareness on the need to meet current and future regulations on carbon emissions, with over a quarter citing it as a key risk for company boards.

“Sustainability is being driven in a few key areas, one of the key drivers are the regulators. As policy makers evolve and standardise their reporting frameworks, the requirements around ESG data become more sophisticated. Therefore, a company’s ESG disclosure and reporting is increasingly more important in order to meet the growing demand of the regulators.” Kelly Perry, of CMC Markets

Greenhouse Gas Protocol

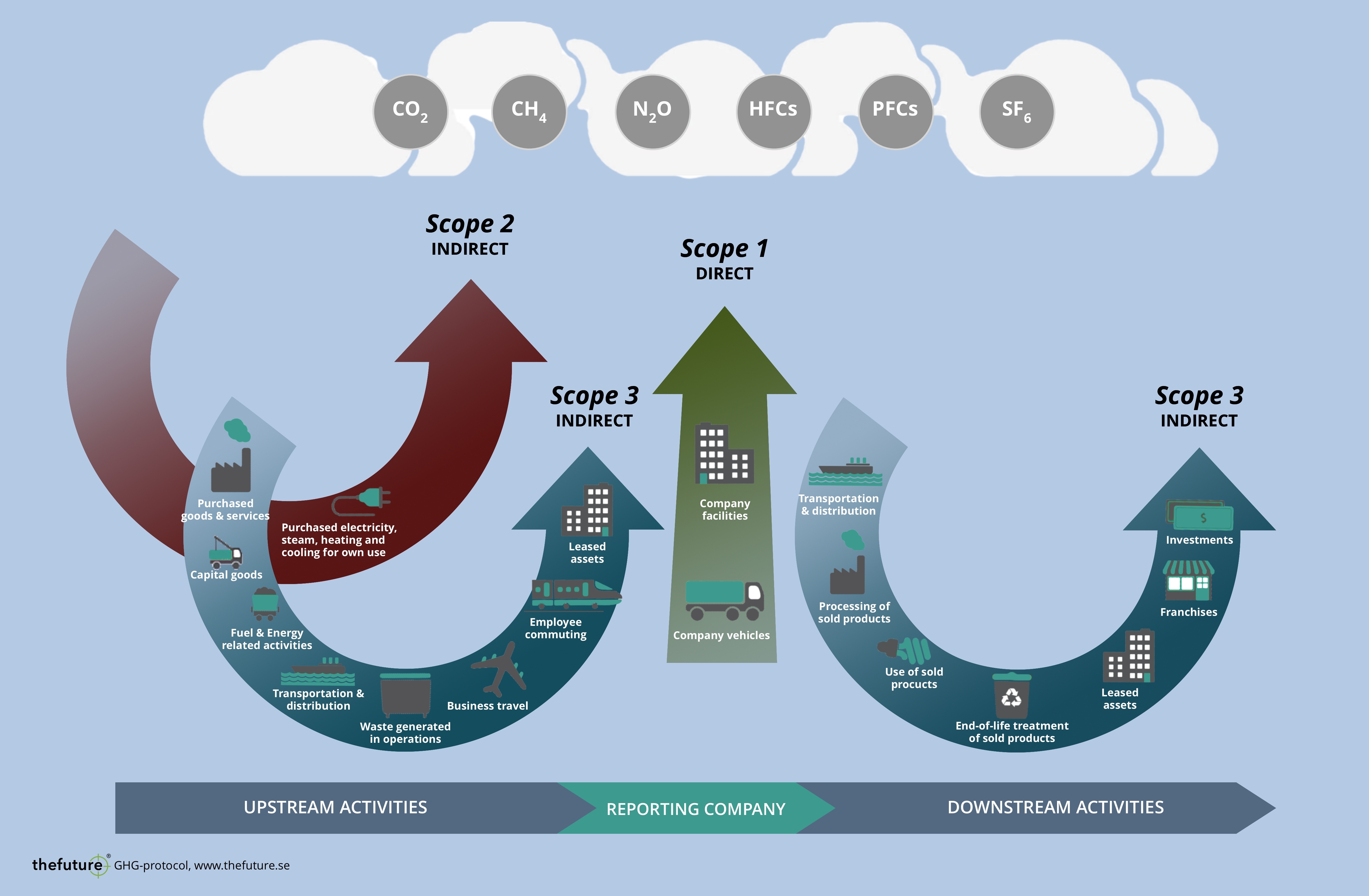

Fintech companies, like their industry counterparts who do report on their individual carbon footprint, in the main follow international standards laid out in the Greenhouse Gas Protocol, which categorises Greenhouse Gas (GHG) emissions associated with a company’s Corporate Carbon Footprint (CCF) as Scope 1, Scope 2, and Scope 3 emissions.

Until recently, the focus for companies has been on reporting emissions from direct operations and electricity consumption (Scope 1 & 2). Scope 3 is undoubtedly much harder to measure, as it covers reporting on the carbon emissions which include everything beyond a company’s direct operations and electricity use, including supply-chain operations and end-product usage by customers.

The following image is a graphical representation of the direct emissions from Scope 1 and the indirect emissions from Scope 2 & 3 resulting from Upstream & Downstream activities. The GHG emissions listed here are Carbon Dioxide - CO₂, Methane - CH₄, Nitrous Oxide- N₂O, Hydrofluorocarbons - HFC, Perfluorocarbons - PFC and Sulphur hexafluoride - SF₆.

Storage

For fintech companies, Scope 3 will likely exceed 90%+ of emissions and includes the entire upstream value chain, suppliers and of course where companies store their data. This shone through in the report with boardrooms increasingly concerned over their sustainable impact and where their data is stored and processed.

Over half of respondents said they are concerned about their company’s environmental impact. And an even higher number agree that it is a moral imperative to limit their company’s environmental impact. And with data storage and processing needs set to increase exponentially over the next few years, deciding on where to place that data has never been more relevant.

To read the full report - The Data Usage Barometer - click on the link here

Back to Newsroom

Back to Newsroom